About Kvika

Kvika’s core values are long-term thinking, simplicity, and courage. The Group focuses on fostering long-term relationships with its customers by providing high-quality and efficient financial services in core areas.

Operations

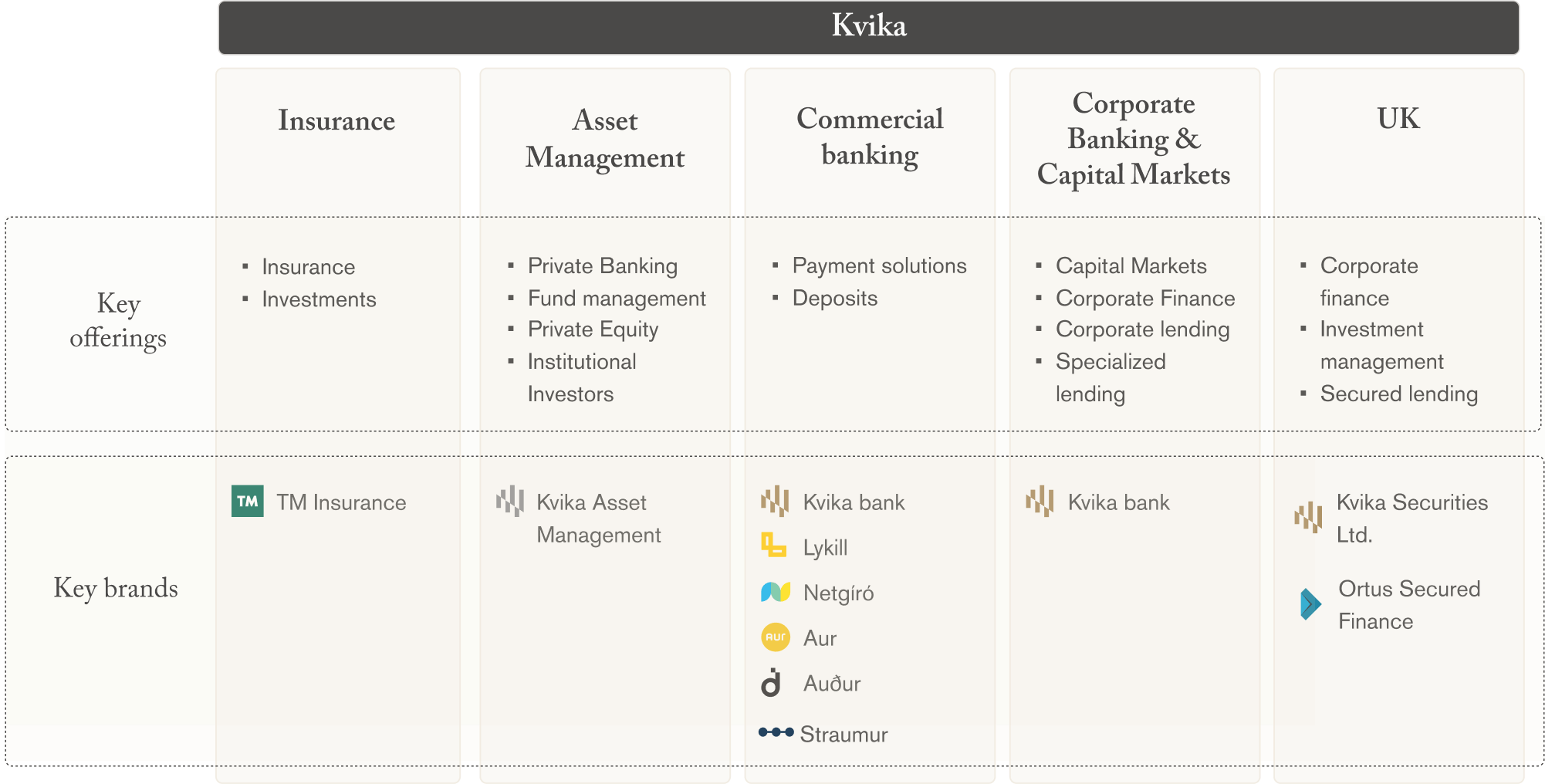

Kvika Bank is the parent company of the Kvika Group, which consists of five revenue divisions, two which are operated under the Kvika Bank brand and three in own-brand subsidiaries.

Kvika's strategy

Kvika’s core values are long-term thinking, simplicity, and courage. The Group focuses on fostering long-term relationships with its customers by providing high-quality and efficient financial services in core areas.

Corporate Governance

You can find information on governance, policies, certification, articles of association, general meetings, and rules of procedure here.

Human resources

We aim to be an attractive workplace where all staff enjoy equal opportunities.

Subsidiaries

You can find information on Kvika's subsidiaries here

Media

Contact information for the bank's operations.

General Terms and Policies

Kvika's General Terms and Policies can be found here. It is important that new clients familiarize themselves with their content.